Upi ,UPI Lite and UPI Lite x all methods full information

UPI, or Upi full form (Unified Payments Interface), is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows users to transfer funds instantly between bank accounts using their smartphones.

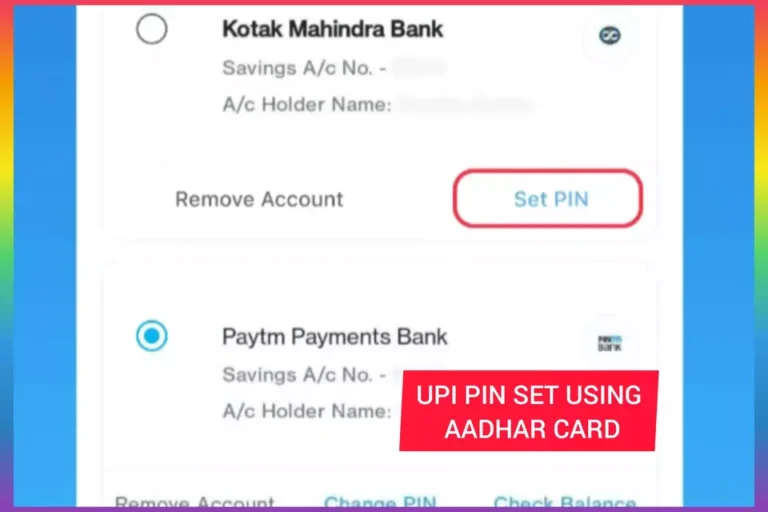

Upi pin set without debit card using Aadhar cards

UPI has revolutionized digital payments in India by offering a seamless, secure, and convenient way to make transactions, enabling users to pay bills, transfer money, and make purchases with ease.

Table of contents

How to work a UPI?

To use UPI effectively, follow these steps:

- Choose UPI-Enabled App: Download a UPI-enabled app from your app store. Popular options include Google Pay, PhonePe, Paytm, and BHIM.

- Register: Sign up using your mobile number linked to your bank account. The app will guide you through the registration process, which usually involves verifying your phone number via OTP.

- Link Bank Account: Select your bank from the list and link your bank account to the UPI app. You may need to provide additional verification details.

- Set UPI PIN: Create a UPI PIN, a secure 4-6 digit code, which will be used to authorize transactions. This PIN is required for every payment.

- Choose Transaction Option: You can now choose from various transaction options such as sending money, requesting money, paying bills, or making purchases.

- Enter Recipient Details: To send money, enter the recipient’s UPI ID, mobile number, or bank account details, along with the amount you want to transfer.

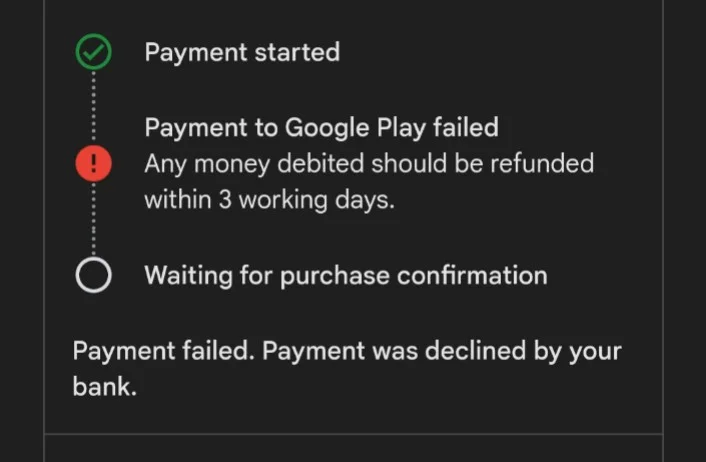

- Authenticate Transaction: Confirm the transaction by entering your UPI PIN. This ensures the security of the transaction.

- Transaction Confirmation: Once the transaction is confirmed, both you and the recipient will receive instant notifications.

- Check Transaction History: You can review your transaction history within the app to keep track of your payments and receipts.

- Security Measures: Always keep your UPI PIN confidential, and be cautious when making transactions. Verify recipient details before confirming payments to avoid any errors.

By following these steps, you can effectively use UPI for various financial transactions with ease and security.

What is UPI Lite?

UPI Lite is a beta version of UPI It is similar to UPI but slightly different in that they are given manually in steps:

- No PIN required for UPI Lite transactions.

- that’s called pin less payment

- The payment must be pre-funded via UPI.

- A maximum of 2000 rupees can be added to the UPI Lite account.

- Then you can do any transaction without any UPI pin Upto 500.

Advantages of UPI Lite

- Enhanced success rate for UPI transactions.

- Works even when your bank account is unavailable.

- Single-click, single-factor authentication for UPI transactions below ₹ 500

How do I activate UPI Lite account?

- The user needs to open their UPI app(like, phone pe, Paytm, Google pay and bhim).

- Once on the home screen of the app, they will find the option to activate UPI LITE.

- They should click on this option.

- After reading and accepting the terms & conditions, the user will enter the amount they want to add to UPI LITE and select the bank account.

- Next, they will enter their UPI PIN.

- Successfully activated UPI LITE!

If I change my device, what happens to my UPI Lite balance?

Switching from an Android to an iOS device will render UPI Lite unusable. Nonetheless, if you persist with PhonePe on an Android device, your UPI Lite balance remains accessible for payments. It’s advisable to close UPI Lite prior to changing your device.

UPI Lite supported Bank

| SENDING BANK | LITE |

| AU small Finance Bank | Available |

| Axis Bank Ltd. | Available |

| Bank of Baroda | Available |

| Bank of India | Available |

| Canara Bank | Available |

| Central Bank Of India | Available |

| Cosmos Bank | Available |

| Equitas Bank | Available |

| Federal Bank | Available |

| Fincare Small Finance Bank Ltd | Available |

| HDFC BANK LTD | Available |

| ICICI Bank | Available |

| Indian Bank | Available |

| Indian Overseas Bank | Available |

| Janata Sahakari Bank Ltd. Pune | Available |

| Karnataka Bank | Available |

| Kotak Mahindra Bank | Available |

| Paytm Payments Bank | Available |

| Punjab and Sind Bank | Available |

| Punjab National Bank | Available |

| State Bank Of India | Available |

| Saraswat Bank | Available |

| Svc co-operative bank ltd | Available |

| Tamilnad Mercantile Bank | Available |

| UCO Bank | Available |

| Union Bank of India | Available |

| Utkarsh Small Finance Bank | Available |

| Yes Bank | Available |

| Last Update | 08/02/2024 |

What is UPI lite X?

Introducing UPI Lite X – Simplifying offline payments with ease, efficiency, and speed!

- With UPI Lite X, you can effortlessly make payments even in areas with weak connectivity and unreliable networks.

- It’s incredibly straightforward – no internet connection required on either the sender’s or recipient’s device.

- Whether you’re in a flight, elevator, or basement, UPI Lite X facilitates offline transactions seamlessly, debiting from the sender’s bank and crediting to the receiver’s bank.

- Convenient and hassle-free.

Features of UPI lite x

- Both the person paying and the person receiving the payment need to have UPI Lite X offline mode activated.

- Uses the current UPI Lite wallet for offline transactions.

- The upper limit for both offline transactions with LITE X and online transactions with UPI Lite is ₹500.

- Transactions can happen with or without internet connection.

- Controlled by customizable risk rules; currently, you can make one debit and 10 credit transactions offline.

- The user must go online, meaning they need internet connectivity, within 4 days of making an offline transaction.

- Currently available on Android smartphones.

Advantage of UPI Lite x

- Better Success Rates: Enjoy improved success rates with UPI Lite X transactions.

- You can make offline transactions without needing an internet connection.

- Improved Accessibility: Conduct more transactions in areas with weak or unreliable networks, such as flights, parking lots, hiking trails, and more.

FAQs Related UPI, UPI lite and UPI lite x?

Unified Payments Interface.

No, no pin required.

Maximum can add 2000 Rupees.

Yes, UPI Lite X is indeed an offline transaction.

You will contact the bank account from which you activated UPI Lite.